THIẾT KẾ NỘI THẤT

3 Account You to definitely Insure Excessive Deposits

Articles

Put products and related features are provided because of the JPMorgan Pursue Financial, N.A great. Associate FDIC. Speaking of put account kept because of the a rely on based by statute or a composed believe agreement, in which the creator of the believe (grantor/settlor/trustor) contributes finance otherwise assets and offer upwards all-power so you can cancel otherwise alter the believe. Enter all of your private, company, and you may regulators accounts for you to bank, next experience all about three steps to generate a report.

Digital Money Transfer Agreement and you can revelation private and you will industrial profile

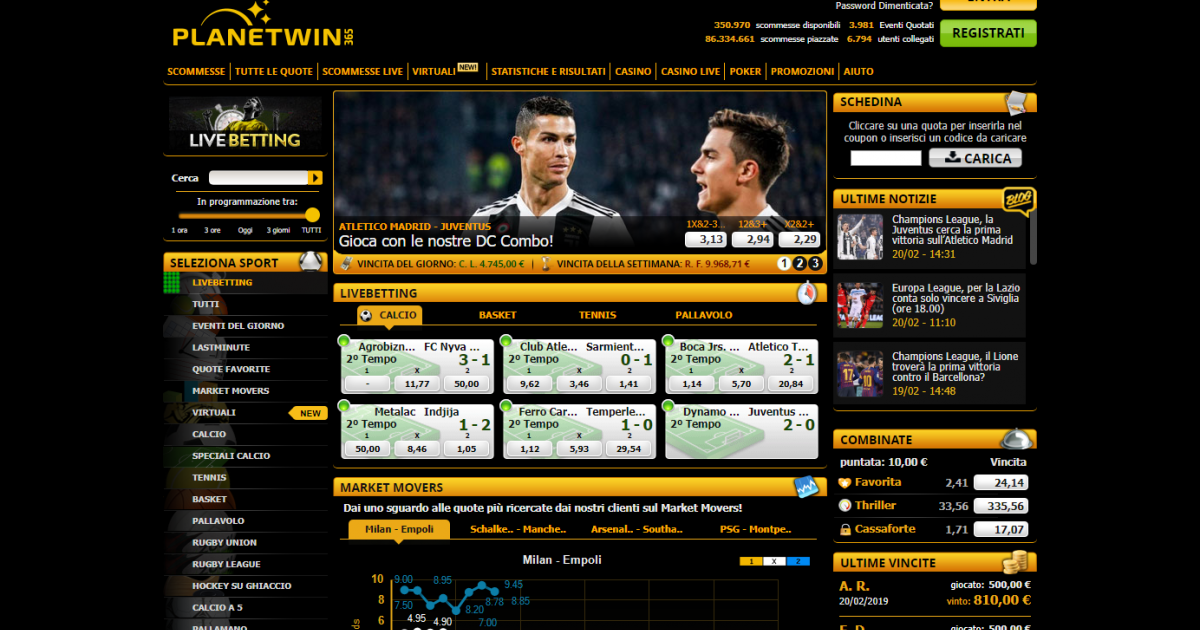

The minimum required amount are different and alter based on the supplier you decide on. This guide can tell you helpful hints the web Gambling establishment and Sweepstakes Web sites offering a low dumps, in addition to $1 minimal deposit gambling enterprises Us, allowing you to play on a funds. Before you choose a gambling establishment, always check the banking webpage to make certain they supports $step one places and provides detachment actions that actually work for you. Listed here are the best percentage alternatives for $step 1 minimum put casinos labeled by what he’s better put to have.

What’s the difference between Vanguard Cash Put and Cutting edge Cash And Account?

Dvds regarding the presumed financial is actually independently insured through to the earliest maturity day following the prevent of one’s half a dozen-month elegance months. Dvds you to definitely adult in the six-month period and so are restored for the same identity as well as in an identical dollars matter (possibly that have otherwise as opposed to accrued interest) are still individually insured through to the very first readiness date just after the fresh half dozen-week several months. If a Video game matures inside six-day sophistication period that is revived to your all other base, it will be on their own insured simply before end of the six-few days grace period. Home loan Servicing Membership try profile maintained by the a mortgage servicer, in the a great custodial or any other fiduciary skill, which are comprising payments by the mortgagors (borrowers) out of dominating and you may interest (P&I). The newest identity out of in initial deposit since the a keen HSA, including “John Smith’s HSA,” is sufficient to have titling the newest put as qualified to receive Single Membership otherwise Faith Membership visibility, depending on if qualified beneficiaries is actually entitled.

More In your Currency

- The fresh NCUA handles and you will operates the brand new Federal Borrowing Partnership Express Insurance rates Finance (NCUSIF), with regards to the NCUA website.

- We now have listed part of the downsides according to a casino that have a great $step 1 minimal deposit.

- Including, having a threshold away from 40 debts, maximum you can put will be $4,one hundred thousand (inside $a hundred debts).

Such as, landlords in the Los angeles and you may San francisco bay area have to give desire, however, Ca has no such controls. FDIC insurance coverage along with hides so you can $250,100 for each and every co-manager of a joint membership. That way, you and your spouse have independent accounts for each and every which have $250,000, in addition to a shared membership that have as much as $five hundred,00, all of the in one lender. How to insure excessive deposits above the $250,100000 FDIC limit can be spreading currency around to some other banks. Let’s state you’ve got $fifty,100 you to’s perhaps not covered at your most recent financial. You could put they to the an economy otherwise currency market account at the another lender and it also might possibly be covered there.

In that case, sometimes since you stole it or obtained stolen dollars, they have to twice-consider the individuals amounts facing one account of cash burglaries for their research. For that reason, buyers with $250,100 in the a great revocable faith and you will $250,100000 in the an irrevocable believe at the same financial may have the FDIC publicity reduced out of $five hundred,one hundred thousand in order to $250,100, according to Tumin. We are going to tell you the outcome within around three (3) working days just after finishing all of our research.

Per recipient of one’s faith have an excellent $250,000 insurance restriction for as much as four beneficiaries. Yet not, if there are other than simply five beneficiaries, the new FDIC visibility limitation to the believe account stays $step one.25 million. FDIC insurance policies basically covers $250,one hundred thousand for each depositor, for each and every lender, in the for each and every membership possession group. A customer membership are a free account kept because of the just one and you can put primarily for personal, family members, otherwise home objectives. I reserve the right to transform the charges, this type of Legislation and one otherwise all agreements, disclosures, or any other documents incorporated because of the reference when. Whenever we alter these Legislation, the newest up coming-newest kind of such Regulations supersedes all earlier versions possesses the newest terms ruling your bank account.

Certain broker membership supply usage of a fund field fund instead of in initial deposit account, nevertheless these fund aren’t safeguarded lower than FDIC insurance coverage. Money in such finance is frequently committed to cash and you can small-name regulators bonds, so they really are usually reported to be safer assets. They often times render highest efficiency than simply antique discounts membership and certainly will become recommended to have an excessive amount of bucks.