THIẾT KẾ NỘI THẤT

The Ultimate Guide to Choosing a Trading Platform for Forex 1972693422

The Ultimate Guide to Choosing a Trading Platform for Forex

In the ever-evolving world of forex trading, selecting the right trading platform for forex tradingarea-ng.com is crucial for success. With countless options available, traders need to consider several key factors that can influence their trading experience and outcomes. This article delves into the essential elements to consider when choosing a trading platform, ensuring you make an informed decision that aligns with your trading goals.

Understanding the Basics of Forex Trading Platforms

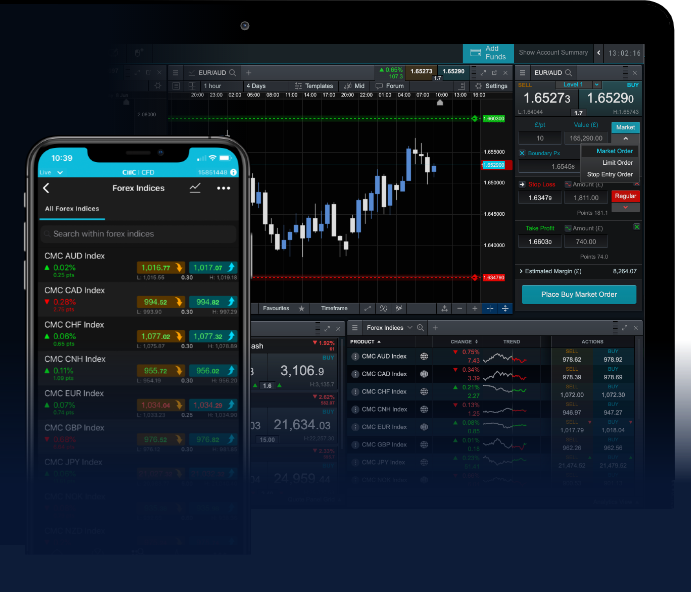

A forex trading platform is the software application that enables traders to access the foreign exchange market. These platforms allow traders to execute trades, analyze charts, and manage their accounts. Different platforms offer various features, so understanding their functionalities is the first step to selecting the ideal one.

Types of Trading Platforms

There are generally two types of trading platforms: web-based and downloaded applications.

- Web-Based Platforms: Accessible through internet browsers, these platforms do not require any downloads. They are ideal for traders who need flexibility.

- Desktop Applications: These require installation on your computer and often provide advanced features and tools that may not be available in web-based versions.

Key Factors to Consider When Choosing a Forex Trading Platform

When evaluating potential trading platforms, consider the following factors:

User Experience

The platform’s interface should be intuitive and easy to navigate. A well-designed platform enhances the trading experience by allowing traders to access essential features quickly. Look for platforms that offer customizable layouts and user-friendly navigation.

Regulation and Security

Regulation is vital in the forex industry. Ensure that the platform is regulated by recognized authorities, which indicates adherence to specific standards. Additionally, the platform should have robust security measures, such as encryption and two-factor authentication, to protect your funds and personal information.

Trading Tools and Features

Different platforms come with various tools designed to enhance your trading experience. Look for features such as:

- Charting Tools: Advanced charting capabilities can help you analyze market movements.

- Technical Indicators: These tools help traders assess market trends and potential entry or exit points.

- Automated Trading: Some platforms offer options for algorithmic trading or trading bots.

Fees and Commissions

Understanding the fee structure is essential since it can significantly impact your overall profitability. Look for transparency in commissions, spreads, and withdrawal fees. Some platforms may offer competitive pricing, but there may be hidden fees that can eat into your profits.

Customer Support

Reliable customer support is crucial, especially for beginner traders who may have questions or encounter issues. Look for platforms that offer multiple channels of support, including live chat, email, and phone support. An extensive FAQ section can also be a valuable resource.

The Importance of Demo Accounts

Many platforms offer demo accounts that allow you to practice trading with virtual funds. This feature is exceedingly beneficial for beginners who want to familiarize themselves with the platform without risking real money. It also allows experienced traders to test new strategies or features before committing financially.

Mobile Trading Options

In an age where mobility is vital, the ability to trade on the go cannot be overlooked. Check whether the trading platform offers a mobile application or a responsive web version that works well on smartphones and tablets. A strong mobile platform enables you to monitor your trades and execute orders, regardless of your location.

Integration with Third-Party Tools

Look for platforms that allow integration with third-party trading tools or software. Whether it’s a trading signal service, social trading features, or portfolio management tools, having this flexibility can considerably enhance your trading experience.

Community and Educational Resources

A good trading platform should not only be a place to execute trades but also provide educational resources. Webinars, tutorials, and active community forums can greatly assist traders in improving their skills and strategies. Engaging with a community of traders allows for knowledge sharing and can keep you informed of the latest market trends.

Conclusion

Selecting the right trading platform for forex is a decision that requires careful consideration. By understanding your trading style and preferences and evaluating platforms based on user experience, regulation, fees, features, and support, you can find a platform that aligns with your trading goals. Don’t forget the value of practicing on a demo account to ensure that the platform feels right for you. With the right tools and knowledge, you can navigate the forex market more effectively and increase your chances of success.