THIẾT KẾ NỘI THẤT

Understanding Forex Currency Trading Online A Comprehensive Guide 1959259454

Understanding Forex Currency Trading Online: A Comprehensive Guide

Forex currency trading online has gained significant popularity among investors and traders looking to diversify their portfolios and tap into the vast opportunities presented by the global forex market. Trading currencies can be an exhilarating ride, filled with potential profits but also considerable risks. This comprehensive guide is here to help you navigate the intricacies of forex trading, understand essential concepts, and adopt effective strategies. To get started, you may want to explore the forex currency trading online Best Trading Apps that can aid you in your trading journey.

What is Forex Trading?

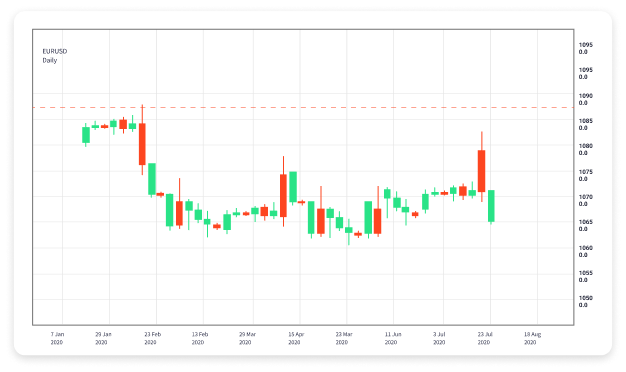

Forex, short for foreign exchange, is the largest financial market in the world, where currencies are traded. Unlike other markets, forex operates 24 hours a day, five days a week, allowing traders to engage at any time that suits them. Forex trading involves the simultaneous buying of one currency and selling of another, which is why currencies are quoted in pairs. For example, the EUR/USD pair reflects how much US dollars are needed to buy one Euro.

The Importance of Currency Pairs

Understanding currency pairs is fundamental to forex trading. There are three types of currency pairs:

- Major pairs: These involve the most widely traded currencies, such as the USD, EUR, and JPY. Examples include USD/JPY and EUR/USD.

- Minor pairs: These pairs do not include the USD but involve other major currencies, such as the EUR/GBP and AUD/NZD.

- Exotic pairs: These involve a major currency and a currency from a developing economy, like USD/TRY (Turkish Lira) or EUR/ZAR (South African Rand).

How Forex Trading Works

Forex trading is conducted over-the-counter (OTC) rather than on a centralized exchange, meaning that all transactions occur directly between parties through electronic networks. Traders place orders via online trading platforms provided by forex brokers, who act as intermediaries between buyers and sellers. Key terms include:

- Bid price: The price at which the market will buy a specific currency pair from you.

- Ask price: The price at which the market will sell a specific currency pair to you.

- Spread: The difference between the bid and ask price, which is often a source of profit for brokers.

- Leverage: A tool that allows you to control a large position with a relatively small amount of capital, increasing both potential profits and risks.

Strategies for Successful Forex Trading

Success in forex trading requires a deep understanding of market dynamics as well as effective strategies. Here are a few popular ones:

- Technical Analysis: This involves using charts and technical indicators to analyze price movements and identify trading opportunities.

- Fundamental Analysis: Traders look at economic indicators, news releases, and geopolitical events to evaluate how they might impact currency values.

- Scalping: This short-term strategy involves making numerous trades over a day to exploit small price movements.

- Day Trading: Traders open and close positions within the same trading day, avoiding overnight risks.

- Swing Trading: This medium-term strategy aims to capture price swings in the market over days or weeks.

Common Mistakes to Avoid

While trading forex can be lucrative, many traders fall victim to common pitfalls. Awareness can help you avoid these mistakes:

- Over-leveraging: Using too much leverage can amplify losses dramatically. It’s crucial to use leverage cautiously.

- Lack of a Trading Plan: Not having a well-thought-out trading plan can lead to impulsive and emotional trading decisions.

- Ignoring Risk Management: Failing to implement stop-loss orders or position sizing can lead to significant losses.

- Overtrading: Trying to chase losses or trading too frequently can deplete your capital and emotional resilience.

Choosing the Right Forex Broker

Selecting a reliable forex broker is crucial for your trading success. Look for the following features:

- Regulation: Ensure that the broker is regulated by a recognized authority to ensure safety and compliance.

- Trading Platform: A good trading platform should be user-friendly, stable, and equipped with the tools you need for analysis.

- Fees and Spreads: Compare the fees associated with different brokers to find the most cost-effective option for your trading style.

- Customer Support: Reliable customer support can be vital, especially for new traders who may encounter issues.

Conclusion

Forex currency trading online offers exciting opportunities for those willing to learn and adapt. With the right knowledge, tools, and strategies, you can navigate this vast market successfully. Remember to practice risk management and never stop learning—forex is a continually evolving landscape. Start your trading journey today, armed with the right information and resources to succeed in the forex market.